What does 2022 hold for XaaS pricing?

Lessons learned from an analysis of the pricing approaches of the Forbes Cloud 100, powered by the XaaS Pricing Platform

When we were considering where to start in building our MVP data product for XaaS Pricing, we had a lot of options. There are a myriad of XaaS sub-markets and thousands of B2B XaaS vendors. Our ambition is to eventually cover them all. The best journeys all start with a single step, however, so we chose to take our first step by focusing on the best (and hottest) in the cloud space": the Forbes Cloud 100.

We landed on 55 core metrics to cover in the platform, and ended up with 1,500+ lines of data and 85,000 unique data records across the 100 companies and 300+ products represented in the Forbes Cloud 100 list for 2021. This formed the foundation of our beta product, which is now available for early access usage.

Data is best shared with a story, though, so we did a deep dive into the outputs and collected our thoughts and projections. These findings will come out soon when we publish our December 2021 State of XaaS Pricing Report, but we’re previewing them here. We’ll link to the report when it comes out, and if you’d like an early copy to preview…just let me know!

Without further ado, here’s what we learned.

A few already-known trends were clearly validated in our data:

Transparency reigns: 89% of the Forbes Cloud 100 have a pricing page, and 75% have some form of quantitative pricing published on the page. Providing details on pricing and commercial packaging is a SaaS expectation.

Get users to the product quickly and on their terms (and for free): This is a core, known tenet of Product-Led Growth (PLG), but not a strong suit of most vendors. Only 19% of the Forbes Cloud 100 products benchmarked have a free trial, and only ~18% that have a free edition. The differentiators, a mere 5%, have both. A free tier is the best pathway for most to embrace PLG.

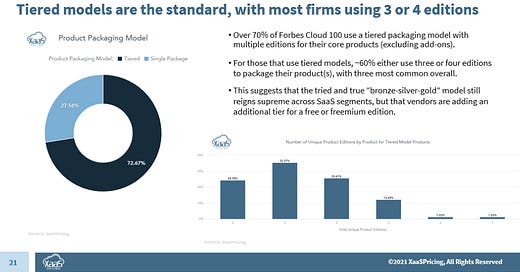

Act like it’s the Olympics: The precious medals tiering approach for SaaS remains the industry standard. Over 70% of the Forbes Cloud 100 offerings we benchmarked use a tiering approach, and ~36% use three tiers. ~26% use four tiers, most commonly because they use a three tier approach plus have added a free or enterprise “contact us” edition.

And a new wrinkle emerged:

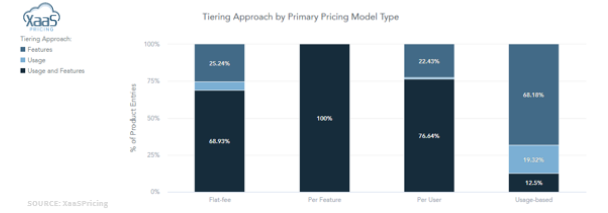

Dipping toes in the usage-based waters… Usage-based pricing is taking root. Kyle Poyar and team from OpenView noted that the number of companies with usage-based pricing increased from 34% to 45% in 2021. This includes true usage-based pricing (23% of companies) and usage-defined tiered subscriptions. We saw similar themes in our data. We tracked 27% of products from the Forbes Cloud 100 that use true usage-based pricing models, where pricing is metered directly by a usage factor. 60% of the companies that use tiering to package their offerings have tiers that are defined by at least one usage-based factor.

…But still anchored to to the “subscription shore”: Over 95% of offerings with usage-based tiers are based on a monthly and/or annual subscription. This is typically priced per user (~56% of offerings tracked) or with a flat-fee (~41%). So companies are governing usage with how they package, but when it comes to monetization, models are defaulting to traditional subscription structures.

So what does that tell us for 2022?

We expect broader usage-based experimentation via flat-fee or per user priced subscription tiers that are governed by limits on up to 5 usage factors

The differentiators already using this model will embrace change (and collect user data) to more frequently evolve their tiers to align to usage patterns. Gitlab is a good example of what we expect here in 2022.

The bleeding edge begins to move from subscriptions to hybrid models that combine subscription and usage pricing elements.

Free editions push toward becoming a prerequisite tier, even for enterprise-facing vendors and industries.

Lagging industries and vendors start to take notice of these trends, creating more demand for revenue growth roles across XaaS.

Best of luck closing out the year and here’s to a great 2022! Shoot me a comment or email at contact@xaaspricing.com if you’d like a copy of the full report mentioned here, are interested in access to the dataset, or want to talk findings or anything else in further detail!